The financial markets have indeed grown so much in the past decade, and stock market trading can appear overwhelming to beginners. However, with the proper information, anybody can explore and manage its complexities. In this beginner’s guide, we’ll break down the basics of the stock market into edible chunks, engaging you to set out on your speculation travel with confidence.

What is the Stock Market?

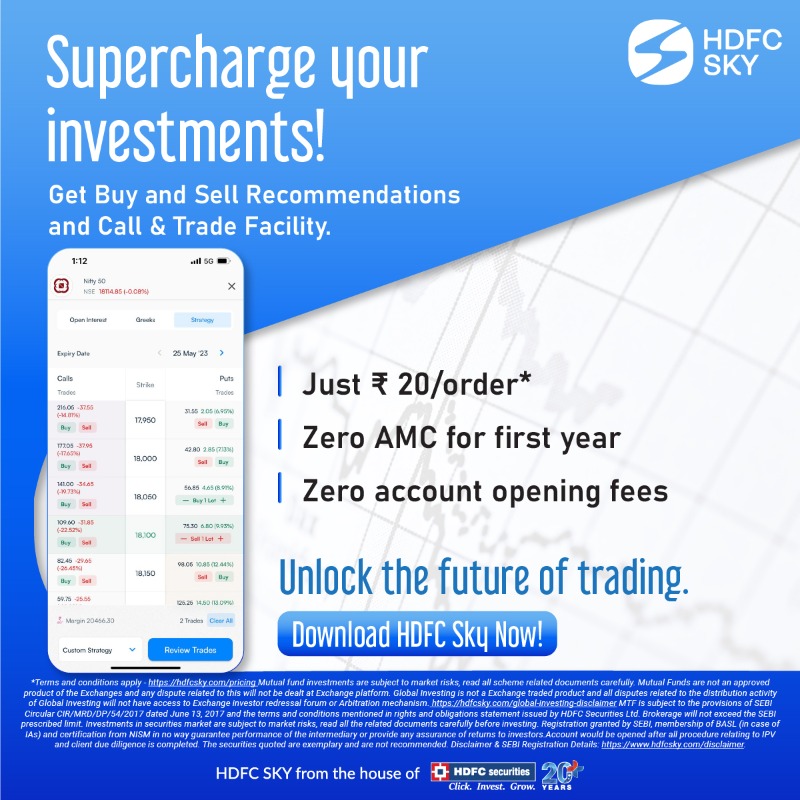

At its center, the stock market is where buyers and sellers come together to trade and invest in shares. Investors participate in the stock market to potentially earn returns on their investments through capital appreciation and dividends. Downloading an app for trading can make investing in the stock market easier and much more accessible.

Key Players within the Stock Market

- Investors: Individuals or institutions who invest capital in the stock market to earn returns on their investments.

- Listed Companies: Corporations that offer shares of ownership to the public through initial public offerings (IPOs) or secondary offerings. These companies are traded on stock exchanges and are subject to regulatory requirements and reporting obligations.

Types of Stocks

Stocks can be divided into common and preferred. Common stocks offer voting rights and potential profits, whereas favored stocks ordinarily do not give voting rights but offer dividends. The choice between the two types of stocks would depend on the trading strategies and goals of the investors. For instance, an intraday trader may lean more toward common stocks for their higher trading volume. Whereas, a long-term, income-oriented investor may also want to explore favored stocks.

Market Indices & Venture Strategies

Market indexes track the execution of a group of stocks, providing insight into the overall market trends. Most investors consider these indexes important for both long-term and intraday trading. Investors utilize various strategies like value investing, growth investing, and dividend investing to achieve their financial goals. Each strategy has its own rules and level of risk.

Understanding Risks and Rewards

Regardless of whether a trader wants to trade intraday or hold stocks for the long term, there are risks involved with every stock market trade. Risks related to loss can arise due to a market crash, changing market sentiment or something else. Managing these risks using strategies like diversification is crucial for long-term success.

Key Investment Principles & Orders

Diversification, asset allocation, and dollar-cost averaging are fundamental principles that help investors manage risks and maximize returns over time. Investors can use various types of orders when trading stocks, including market orders, limit orders, and stop orders. Each order type serves a specific purpose and comes with its advantages and limitations.

The Role of Research

Thorough research is essential before investing in stocks, or transitioning to advanced trading practices like options trading. Analyzing company fundamentals, financial statements, and market trends can guide investors in making informed decisions.

Seeking Expert Advice

For beginners, seeking guidance from financial advisors or experienced investors can provide valuable insights and help navigate the complexities of the stock market, including options trading and more. Making sure you regularly monitor your investments is vital for staying informed about their performance and making necessary adjustments to your portfolio over time.

Conclusion

The stock market could appear overwhelming to begin with, but with persistence, constancy, and a commitment to learning, anybody can become an effective speculator. Remember that investment may not be a sprint, so take your time, remain educated, and make choices based on cautious thought and research. Raising awareness of the basics of trading in India can ensure that every investor makes better decisions, contributing to the country’s economic growth.