With thousands of options available in the stock market everyday, it can be exciting to determine which stocks offer the best mooring for profit. Still, by following a systematic approach and considering crucial factors, investors can make informed opinions and increase their chances of success.

1. Research and Analysis:

Before making a trading account and diving into trading, it’s essential to conduct thorough research and analysis. Start by understanding the different sectors and diligence within the stock market. Estimate current market trends, profitable pointers, and geopolitical factors that could impact specific diligence. Use fiscal news sources, stock screeners, and logical tools to identify implicit openings.

2. Fundamental Analysis:

Fundamental analysis involves assessing a company’s fiscal health, performance, and unborn prospects. Look for companies with strong earnings growth, a competitive advantage, and a solid business model. Review fiscal statements, including income statements, balance wastes, and cash inflow statements, to assess profitability and stability. Pay attention to crucial criteria similar to earnings per share( EPS), profit growth, and profit perimeters.

3. Technical Analysis:

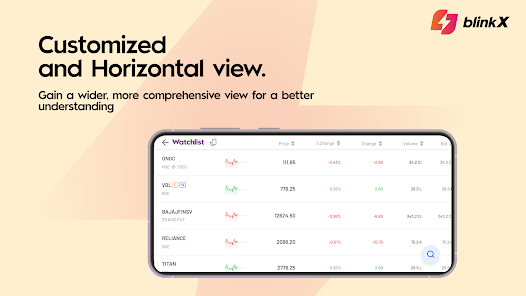

Technical analysis focuses on assaying price movements and map patterns to prognosticate unborn stock performance. While using a trading app, use specialized pointers similar to moving parts, relative strength indicators ( RSI), and MACD to identify trends and implicit entry and exit points. Look for patterns similar to support and resistance situations, trendlines, and map conformations that indicate bullish or bearish sentiment.

4. Risk Management:

Managing threats is pivotal when using a stocks & share market app for trading stocks. Establish clear threat parameters, including maximum loss limits and position sizing rules. Use stop-loss orders to cover against significant losses and apply proper position sizing to manage portfolio threats. Diversify your portfolio across different sectors and diligence to alleviate sector-specific pitfalls.

5. Liquidity and Volume:

Consider the liquidity and trading volume of a stock before entering a trade. Liquid stocks with high trading volume generally have tighter shot-ask spreads and offer better prosecution prices. Avoid thinly traded stocks or those with low average daily volume, as they may be prone to price manipulation and increased volatility.

6. Stock Market Sentiment:

Investors should pay attention to market sentiment and investor psychology when opting for stocks to trade. Sentiment pointers similar to the put/ call rate, investor sentiment checks, and news sentiment analysis can give perceptivity into market sentiment and implicit market reversals. Be conservative of stocks with exorbitantly bullish or bearish sentiment, as they may be prone to sharp price movements.

7. Catalysts and Events:

Identify implicit catalysts and events that could impact a stock’s price movement. This includes earnings reports, product launches, nonsupervisory adverts, and macroeconomic events. Anticipate market responses to these events and acclimate your trading strategy consequently. Be set to reply snappily to breaking news and market developments.

8. Constant learning and adaptation:

The stock market is dynamic, so it’s really important to stay informed and adapt your trades to changing market conditions. Keep a journal to track your investments and dissect performance over time. Acclimate your trading strategy as demanded grounded on market feedback and particular experience.

In closing:

Choosing the right stocks to trade requires a combination of exploration, analysis, and threat operation. By conducting thorough exploration, exercising both abecedarian and specialized analysis, managing threats effectively, and staying informed about market sentiment and catalysts, investors can increase their chances of success. Flashback to continuously learn and acclimatize your trading strategy to navigate changing market conditions effectively.