Owning a demat account is now absolutely necessary in the current investment scene. It is not optional. Whether you are a novice just beginning to investigate the stock market or a seasoned trader, your investment path starts with a demat account. Still, what precisely makes it so indispensable?

Let’s explore the reasons every investor needs a demat account and how its several demat account features could simplify and improve your trading experience.

Understanding the Demat Account

Short for dematerialized account, a demat account is an electronic repository whereby investors may retain their securities in digital form rather than physical certificates. This change from physical to electronic holding has transformed management of investments. The days of handling labor-intensive documentation and risks including theft or damage to share certificates are long gone. Your holdings are safely kept and controlled electronically today, which speeds trading.

Crucial for Investing and Trading

On the stock exchange, you must have a demat trading account connected to your trading platform whether you wish to purchase or sell bonds, mutual funds, shares, or another assets. During transactions, this link guarantees smooth transfer and settling of securities. Owning shares is not possible in the computerized trading environment that rules today’s markets without a demat account.

Furthermore, a demat trading account speeds up transactions, therefore reducing delays and mistakes. It also provides real-time viewing and tracking of your investments, hence improving your portfolio control.

Important Demat Account Characteristics Designed for Investor Advantage

The breadth of services a demat account provides that makes investing quick and easy, which is one of the key reasons one needs one. First of all, the account offers consolidated holding statements that allow you view of your whole investment portfolio in one location.

Still another important advantage is security. The likelihood of fraud, forgeries, or loss is much lowered with electronic holdings. Many demat accounts also provide automatic corporate advantages such rights issues credited directly to your account, dividends, and bonus shares.

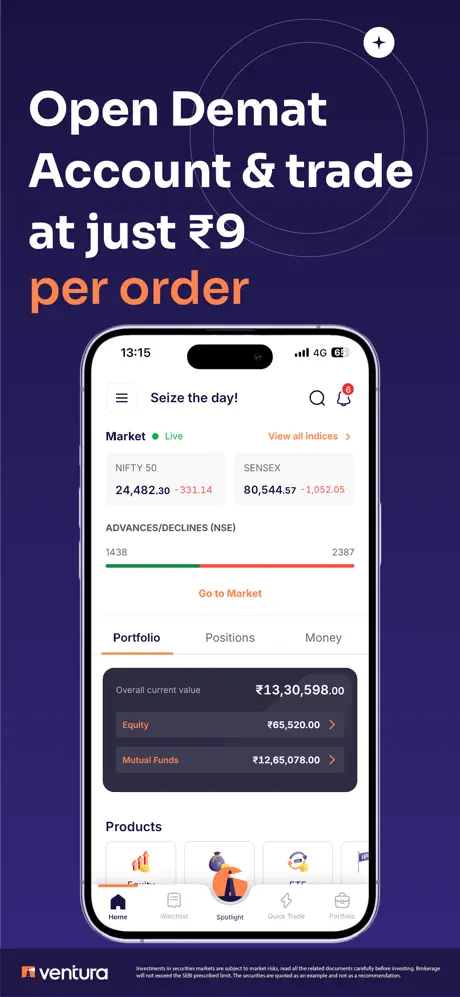

One big plus also is flexibility. Your demat account can be linked to several trading platforms, and many brokers provide specific demat account apps that let you handle your money wherever. These tools help you to make wise judgments anywhere, at any time by offering simple access to market data, quick updates, transaction notifications, and user-friendly interfaces.

Accessibility and Simplicity

The advent of digital technology means you may handle your investments without visiting a broker or bank. From your smartphone, you may check your portfolio, purchase and sell shares, even access research papers and instructional tools using a demat account app.

New investors who wish to remain involved with their investments without complex procedures especially need this degree of accessibility. Modern demat account applications guarantee that trading is not only for the professionals but also within reach for everyone by their convenience.

Transparency and Compliance for Regulation

Having a demat account also implies your investments follow rules established by the Securities and Exchange Board of India (SEBI) and other agencies. With a demat account, the openness and simplicity of record-keeping help you to keep accurate financial records and manage your assets for tax purposes.

Conclusion:

All things considered, in the digital era of today savvy investing depends mostly on a demat account. Its security, simplicity, and large features not only guard your assets but also simplify portfolio administration and trading. Whether you intend to trade regularly or just hold shares for the long run, a demat trading account connected with a trustworthy demat account software offers the necessary instruments to succeed.

Now is therefore the ideal moment if you have not yet opened your demat account. Accept the ease, control, and confidence of the future of investing.