Investing in the stock market has become increasingly accessible, thanks to technology and digital platforms. For anyone looking to begin their investment journey, understanding how to open a Demat Account and use a Trading App is crucial. A Demat Account stores your shares electronically, eliminating the need for physical certificates, while a Trading App allows you to buy and sell shares efficiently from your smartphone or computer.

Opening a Trading And Demat Account might seem complex initially, but the process is straightforward if approached step by step. This will walk you through the essentials, from understanding account types to completing registration and starting your investment journey.

Understanding Demat Accounts and Trading Apps

What is a Demat Account?

A Demat Account (short for Dematerialized Account) is a digital account that holds your shares and securities in electronic form. Traditionally, physical share certificates were issued, which were prone to theft, loss, and damage. With a Demat Account, you can safely store shares, bonds, government securities, mutual funds, and other financial instruments electronically.

A Demat Account simplifies transactions and ensures that your investments are easily traceable and secure. It is mandatory for anyone participating in the stock market to have a Demat Account to buy or sell securities.

What is a Trading App?

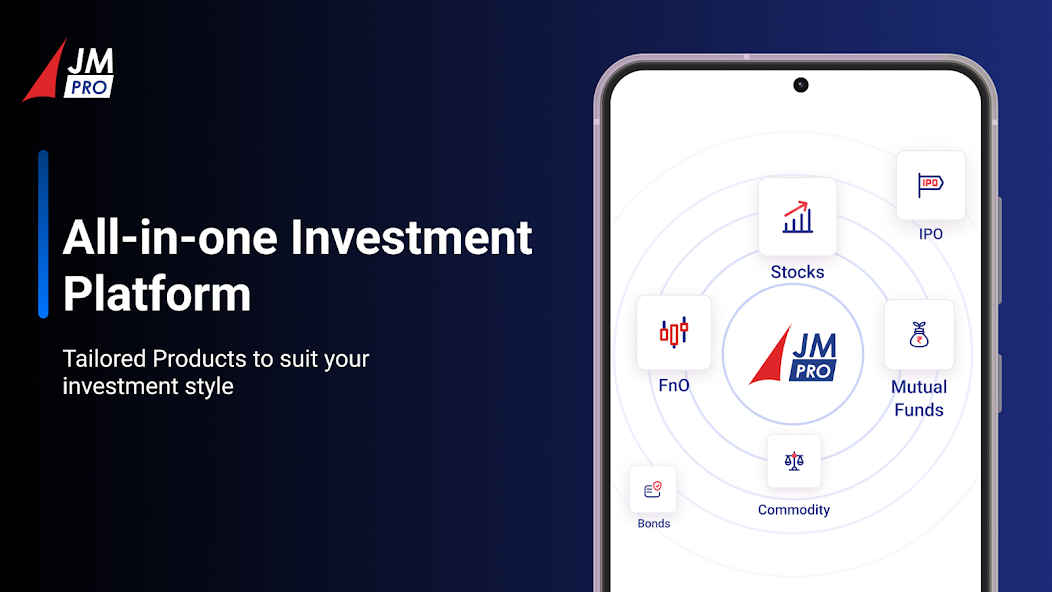

A Trading App is a platform that allows investors to execute trades directly from their mobile devices or computers. It connects to your Demat Account and provides real-time market updates, trading charts, and portfolio management tools. Trading Apps have made stock trading accessible for both beginners and experienced investors by offering user-friendly interfaces and efficient order execution.

Steps to Open a Trading And Demat Account

Opening a Trading And Demat Account involves a series of steps that ensure security, legal compliance, and convenience. Here is a detailed step-by-step guide:

1. Choose the Right Broker or Platform

Start by selecting a reliable brokerage or investment platform that offers both Demat and Trading Accounts. Look for platforms that provide good customer service, low fees, and easy navigation. Choosing the right platform ensures a smooth trading experience and better management of your investments.

2. Complete the KYC Process

KYC (Know Your Customer) verification is mandatory before opening any financial account. You will need to submit identity proof (such as a government-issued ID), address proof, and a passport-sized photograph. Some platforms may also require a scanned signature and PAN card details for verification. Completing KYC ensures compliance with regulatory requirements and protects your investments.

3. Fill the Application Form

Once the KYC process is complete, fill out the application form for the Demat and Trading Account. The form collects personal information, bank details, and investment preferences. Ensure that all information provided is accurate to avoid delays in account activation.

4. Link Your Bank Account

A bank account is necessary to fund your investments and withdraw profits. Linking your bank account to your Trading And Demat Account ensures seamless transfers and real-time settlement of trades. Most platforms support direct debit and credit mechanisms for ease of transactions.

5. Receive Your Account Credentials

After verification, you will receive your account details, including login credentials for the Trading App and the Demat Account. These credentials allow you to access your portfolio, monitor investments, and execute trades securely. Always keep these credentials confidential to prevent unauthorized access.

Features to Look for in a Trading App

Selecting the right Trading App is essential to optimize your trading experience. Here are key features to consider:

- User-Friendly Interface: The app should be easy to navigate with simple menus and clear charts.

- Real-Time Market Data: Access to live prices, news, and analysis helps in making informed decisions.

- Order Placement and Execution: Quick and accurate order execution is crucial to capitalize on market opportunities.

- Portfolio Management: Track holdings, gains, and losses efficiently within the app.

- Security Features: Look for apps with two-factor authentication, encryption, and secure login.

A Trading App combined with a Demat Account allows investors to monitor and control their investments conveniently, anytime and anywhere.

Benefits of Having a Demat Account with a Trading App

- Secure Storage of Securities: Physical certificates are prone to loss and damage. A Demat Account keeps your shares and bonds safe in digital form.

- Convenient Trading: Buying and selling securities is faster and simpler through a Trading App.

- Reduced Paperwork: Digital accounts reduce administrative processes and eliminate the need for physical documentation.

- Quick Settlements: Transactions are processed efficiently, and funds are reflected in your account without delays.

- Portfolio Tracking: A Demat Account linked with a Trading App helps track performance, analyze trends, and manage investments strategically.

Common Mistakes to Avoid

While opening a Trading And Demat Account is straightforward, some mistakes can impact your trading experience:

- Ignoring Account Fees: Check annual maintenance charges and trading fees before finalizing the account.

- Using Unverified Apps: Always use verified Trading Apps to ensure security.

- Neglecting Risk Management: Understand market risks and avoid over-investing without proper knowledge.

- Incomplete KYC Documentation: Missing documents can delay account activation.

Being cautious and informed ensures a smooth investment journey.

Tips for First-Time Investors

- Start with a small investment to understand market dynamics.

- Use the Trading App to explore features like watchlists, alerts, and research tools.

- Keep learning about market trends and investment strategies.

- Diversify your portfolio to reduce risk.

By combining the knowledge of trading with a secure Demat Account, beginners can confidently enter the market and grow their investments over time.

Conclusion

Opening a Demat Account and using a Trading App is the first step toward efficient and secure investing. By following the steps mentioned above, anyone can open a Trading And Demat Account easily and start building a diversified portfolio. The combination of a digital account and a reliable app ensures safe storage, quick trades, and better portfolio management. Investing in the stock market has never been more accessible, and a well-maintained Trading And Demat Account provides the foundation for long-term financial growth.

With careful planning, informed choices, and proper use of a Trading App, your Demat Account can help you achieve your investment goals securely and conveniently.